Stake Australia: Investing in the US Stock Market? Some first steps from Stake Australia

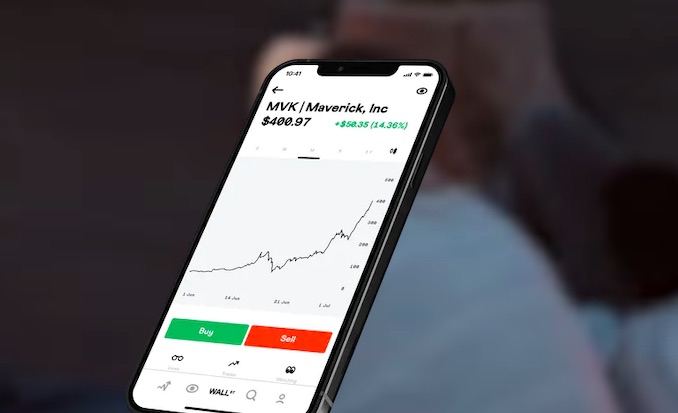

The 21st century is all about challenger fintechs and app-based share trading for everyone. From Australia to the USA and everywhere in-between, investing and day trading are big business for individuals and the companies like Stake that give them unfettered access to investing in Wall Street. Read more about Stake here, but if you’ve downloaded the app, then here’s some ideas on how to make your first move from the expert themselves. What’s the first step? The S&P500, a basket of America’s 500 biggest companies, has averaged a return of 9% across history. $1000 invested into the S&P500 with $1000 added annually would be worth $150,000 after 30 years. The stock market is one of the greatest wealth-generating engines in the world. You can be part of it. Some investors prefer to actively pick companies they think will grow and increase in price. Are you particularly interested in cars or renewables? Maybe you believe in Tesla. Notice that one of your favourite online brands is always selling out? Maybe it’s worth looking at the stock. Over time, you’ll develop strategies as you gain experience and come across different resources. Remember though, time in the market will always beat timing the market. How many options are out there? Stake has over 6,000 US-listed stocks and ETFs available to investors. From the giants of today like Apple and Amazon, to the game changers of tomorrow like Tesla, investors can find all the companies they know and love on the Stake platform. Some of the most popular stocks… Read More