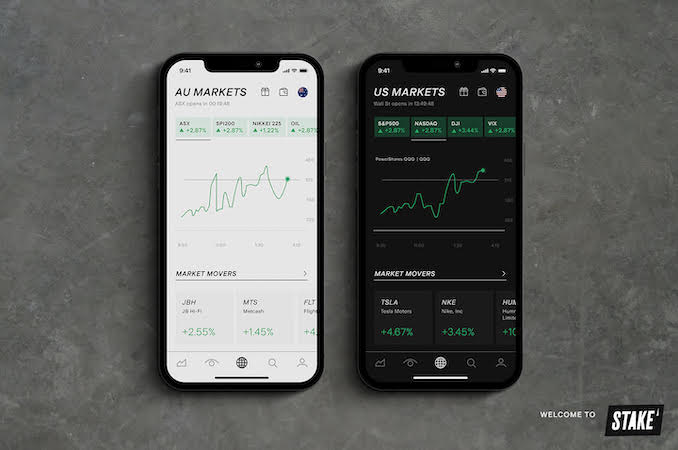

Invest smarter: Stake Black is back with a better offering than ever

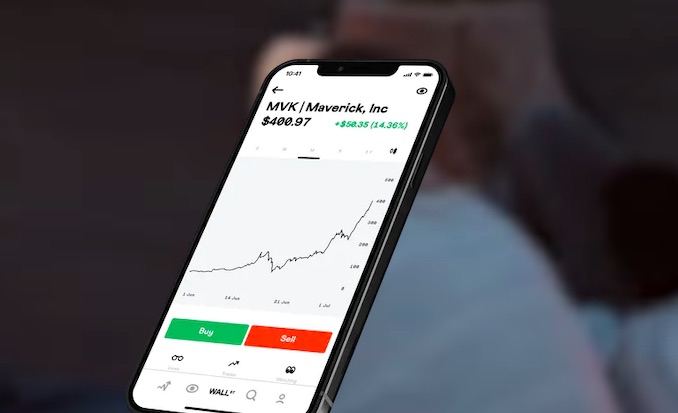

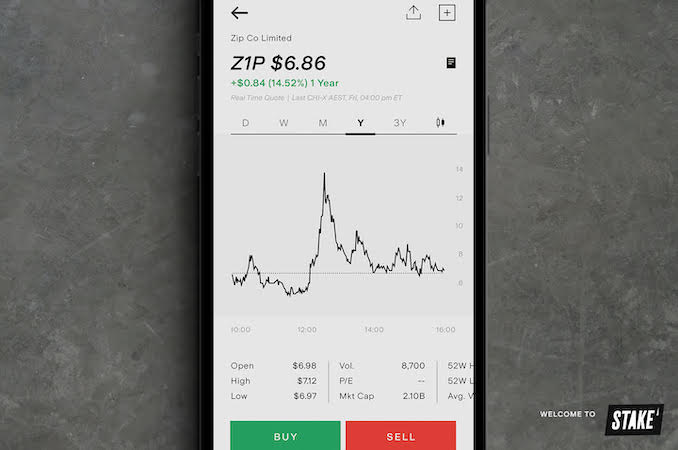

So, if you’re in the investment game in Australia, you’d know about Stake Black. And if not, then sit up and pay attention. The new Stake Black membership is bringing sharper trading tools for the U.S. and Australian markets together for the first time. This includes in-depth data for all ASX equities, plus features such as instant buying power and analyst ratings for U.S. stocks. And if you’re wondering if you’re in good company; Stake recently hit the milestone of over one million trades on the Australian market, and reached $2 billion in assets under administration. Nice. Basically, Stake Black will give you more control of your investing journey, with features that enable a faster response to market movements, data to inform investment strategies and access to a broad range of global securities. In short: In-Depth ASX Data to Help Determine Sentiment, Liquidity and Resistance Levels: access to level 2 data for all ASX equities, including full course of sales and market depth tables, displayed in Stake’s intuitive interface. Access to Unsettled Funds for U.S. Stocks for Faster Trading: instant buying power allows funds from U.S. securities to be reinvested immediately, compared to the industry standard settlement time of the trade date plus two days. Full Financials for U.S. Securities to Support Simpler In-Product Research: stats covering the last eight quarters of cash flow, income, and balance sheet statements for U.S. stocks and ETFs make it easy to stay across the details. Added Clarity Through Analyst Ratings and Price Targets for U.S. Stocks: investors can… Read More